CS Oparanya calls for mergers to stabilise small SACCOs, strengthen sector

Currently, Sasra only oversees Saccos with deposits of Sh100 million or more, leaving many smaller co-operatives under the Commissioner of Co-operatives, where oversight is less strict.

The Ministry of Co-operatives is stepping up efforts to merge smaller Saccos as part of a plan to strengthen regulation and ensure the survival of co-operatives with low capital and limited membership.

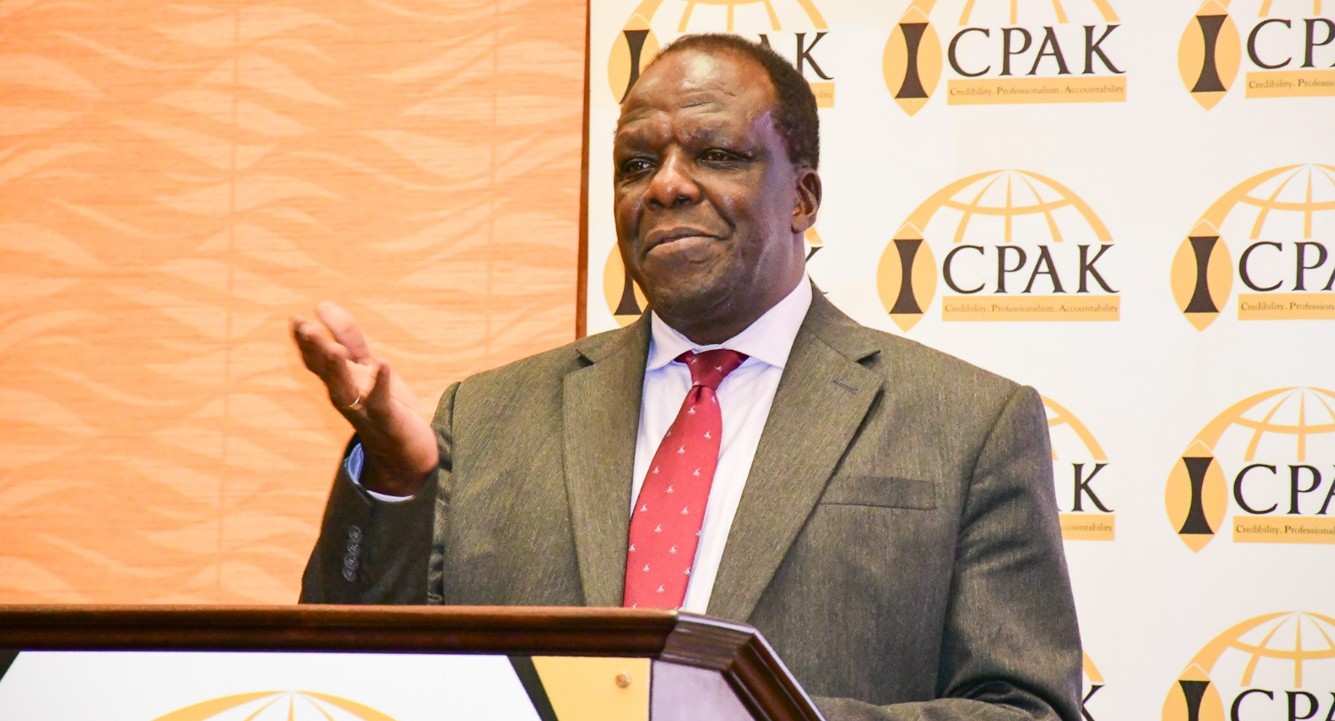

Co-operatives Cabinet Secretary Wycliffe Oparanya said a large number of Back Office Service Activity (Bosa)-only Saccos are either inactive or struggling because they cater to very few members and contribute little to financial inclusion.

More To Read

- Azziad Nasenya moves to court to stop auction of Sh20 million Kileleshwa apartment

- Sacco auditors face lifetime ban for failing to submit mandatory reports, regulator warns

- More SACCOs register with FRC to fight money laundering, terrorism financing

- SASRA on the spot over alleged mismanagement, wrangles at Nandi Teachers Sacco

- Thousands at risk of loan defaults as employers fail to remit Sh4.2 billion to Saccos

- SACCO members hit by 4 per cent payout cuts in wake of Sh13.3 billion KUSCCO heist

In these Saccos, members invest in shares, which are then used to give loans. While share capital cannot be withdrawn, it can be transferred to another member when someone exits the Sacco.

“A time has come for the Sacco sector to explore market-driven solutions of consolidations and mergers of these many small Bosa-only Saccos. This is the only way to ensure their financial viability and stability,” Oparanya said during the launch of the Sacco Supervision Annual Report 2024.

He called on co-operatives with similar social and economic connections to begin talks on merging to secure their future.

The report indicates that among the 177 deposit-taking and 178 non-withdrawable deposit-taking Saccos regulated by the Sacco Societies Regulatory Authority (Sasra), just 40 hold 65.83 per cent of the total Sh749.43 billion deposits.

Oparanya highlighted a recent example in Kirinyaga County, where a small Sacco merged with a larger one, allowing members access to a wider range of financial services.

Consolidation is also seen as a way to make regulation more efficient as the government moves to bring all co-operatives under Sasra’s supervision.

Currently, Sasra only oversees Saccos with deposits of Sh100 million or more, leaving many smaller co-operatives under the Commissioner of Co-operatives, where oversight is less strict.

“Governance in Saccos is still a matter of grave concern for the government,” Oparanya added, stressing the importance of mergers in improving stability and accountability in the sector.

Top Stories Today